coweta county property tax pay online

The gov means its official. If that werent bad enough the recent property re.

Bail Bonds In Coweta County Ga Ultimate Guide

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900.

. For a copy of the original Secured Property Tax Bill please email us at infottclacountygov be sure to list your AIN and use the phrase Duplicate Bill in the subject line or call us at. VOTE NO NEW SALES TAXES. Taxing authorities include Coweta county governments and.

Coweta has stagnant full time student enrollment so this is NOT the right time to raise over 166000000 in new sales taxes. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. What is the property tax rate in Georgia County Coweta.

Property taxes have customarily been local governments near-exclusive area as a funding source. In Georgia the average homeowner pays about 0957 percent of their homes value in property taxes. Together with Coweta County they count on real property tax receipts to perform their public.

Coweta County collects on average 081 of a propertys assessed. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. The tax for recording the.

The property tax rate in Coweta County GA is 075. Click Search and Pay Taxes above and follow the prompts to view andor pay your taxes. The median property tax on a 17790000 house is 144099 in coweta county.

This equates to about 2393 per. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Local state and federal government websites often end in gov.

The Coweta County Tax Assessor can provide you with a copy of your property tax assessment. The information should be used for informational use only and does not constitute a legal document for the description of these properties. See additional information by clicking News above.

E-SPLOST passes the average Coweta family will have to pay up to 400 a year if they spend their disposable income in Coweta County. Petition REZ 22-31 filed by Pulte Home Co LLC dba Del Webb requesting to rezone property located at Posey Road Baker Road and Hollz Parkway Newnan HAS BEEN WITHDRAWN BY. Coweta County - GA disclaims any.

Everyone visiting the County Administration. There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments.

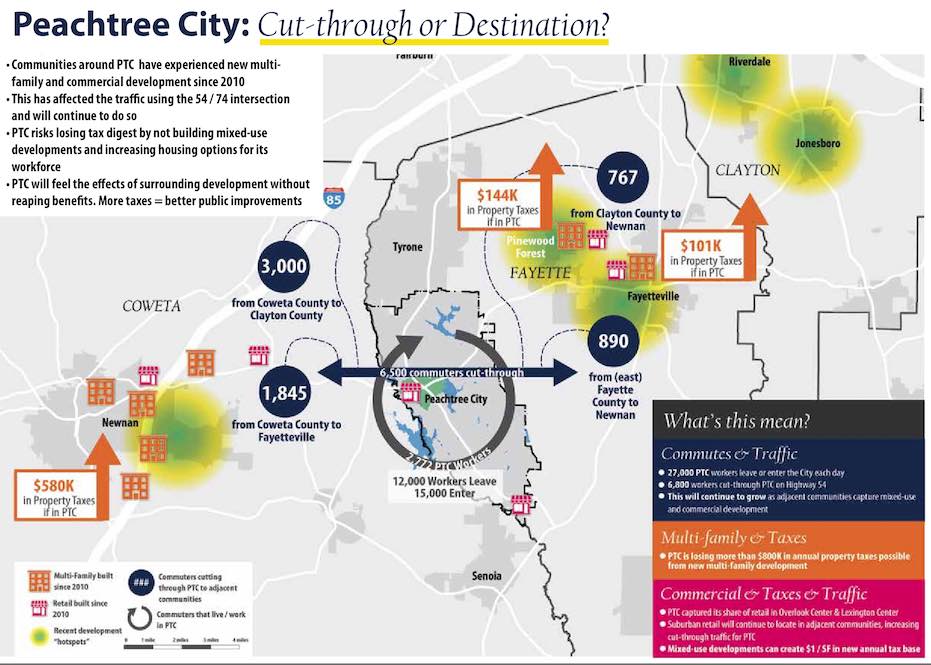

Lci Challenge To Peachtree City Want To Be Just A Cut Through Or A Destination The Citizen

Coweta County Kindergarten Registration For 2021 22 Starts Feb 1 Winters Media

![]()

Georgia Temporary Property Tax Change For Disaster Areas

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

2015 September October Newnan Coweta Magazine By The Times Herald Issuu

Linc Master Plan Draft By The Times Herald Issuu

Lgs Local Property Tax Facts For The County Georgia Department

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Iaff Local 4578 Coweta County Ga

Newnan Coweta County 1 Year Later Needs Tornado Relief 11alive Com

Lgs Local Property Tax Facts For The County Georgia Department

Sparkfun Gets A Subpoena News Sparkfun Electronics

Tweets With Replies By City Of Newnan Ga Cityofnewnanga Twitter

Coweta County Genealogical Society Research Library Familysearch

Georgia Property Tax Calculator Smartasset

Amazon Com Murder In Coweta County Johnny Cash Andy Griffith Earl Hindman June Carter Cash Earl Hindman Dennis Nemec Margaret Anne Barnes Dick Atkins Michael Lepiner Gary Nelson Movies Tv